Message from our CEO

Slow Moving Energy Transition in Asia Pacific

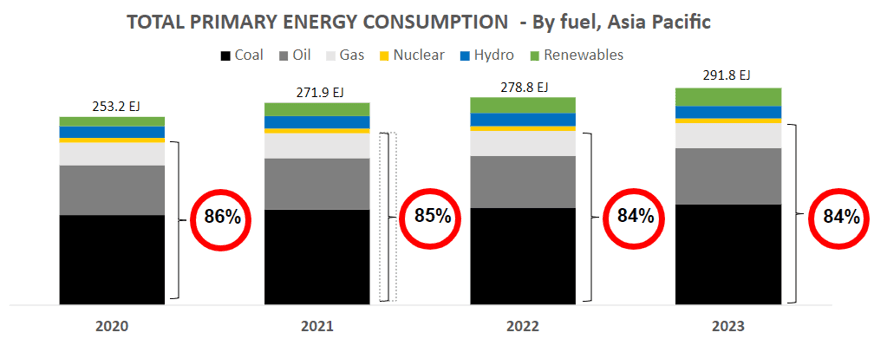

Reliance on coal and fossil fuels in Asia Pacific — around 85% of primary energy — is stubbornly high and falling slowly. The energy transition is both a significant challenge and an investment opportunity.

Climate Change will Significantly Impact Investment Portfolios and Returns

We anticipate the following major themes.

Massive build out of renewables

Low-cost, reliable solar and wind will dominate electricity supply and displace fossil fuels.

Electrify everything

Electrification of transport, industry and heat is the key energy trend and will drive a step change in power demand.

Grid stability and resilience

Enormous investment needed in the electricity grid and battery energy storage systems.

Carbon regulation and disclosure

Ever tightening regulation of carbon emissions and carbon reporting underpinned by carbon taxes and border adjustments.

Real assets, proven technologies

- Solar and bioenergy in select markets

- Invest in proven technologies in power markets where renewable energy is priced at realistic, economic levels

- Invest early in project development life cycle

- Early-stage investment managed by an experienced team is key to manage risks effectively and achieve attractive investment returns

- Maintain control of investments

- Retaining control is a key lesson from real estate and renewables PE funds. Enables investment team to build scale, refinance and exit.

- Utilise prudent leverage

- Arrange sustainability-linked financings to achieve optimum credit terms and loan pricing. Avoid risk from excessive leverage.

- Readiness for environmental markets

- Carbon credits and renewable energy certificates offer potential upside for projects with a good sustainability track record provided they are properly registered.

- Impact and Sustainability

- Deliver annual report card on emission reductions and contribution to targeted Sustainable Development Goals.

Where will we invest?

Our focus is investment grade markets in Asia Pacific with strong renewable energy potential. We anticipate solar and bioenergy investments in Australia and New Zealand will dominate our first fund.

SC Oscar team members have built up extensive networks over 25 years in regional markets giving us an advantage in securing investment opportunities. The team has deep knowledge of project finance and carbon markets.

New Zealand Solar

New Zealand solar resource is comparable to Mediterranean countries. However, solar power generation supplies only 1% of New Zealand's electricity needs compared to around 2% in Singapore, 10% in Japan and 18% in Australia. New Zealand's power system is dominated by hydro and geothermal. Solar power is complementary and will help meet the aspirational national target of 100% renewable electricity by 2030. The country's high sovereign rating, commitment to achieve net zero, optimal solar resource and stable, competitive electricity market make this an attractive target sector and market for SC Oscar.